The Fiasco of Terra(LUNA) and UST Explained

The Downfall of Terra(LUNA)

Table of contents

What is Terra(LUNA)?

Terra(LUNA) was founded by Daniel Shin and Do Kwon in 2018 and it is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. Terra claims that its use of fiat-pegged stablecoins distinguishes it from the competition by combining the borderless benefits of cryptocurrencies with the day-to-day price stability of fiat currencies. It maintains its one-to-one peg thanks to an algorithm that adjusts stablecoin supply in response to demand. It accomplishes this by incentivizing LUNA holders to swap LUNA and stablecoins at profitable exchange rates as needed to expand or contract the stablecoin supply to meet demand.

The Crash

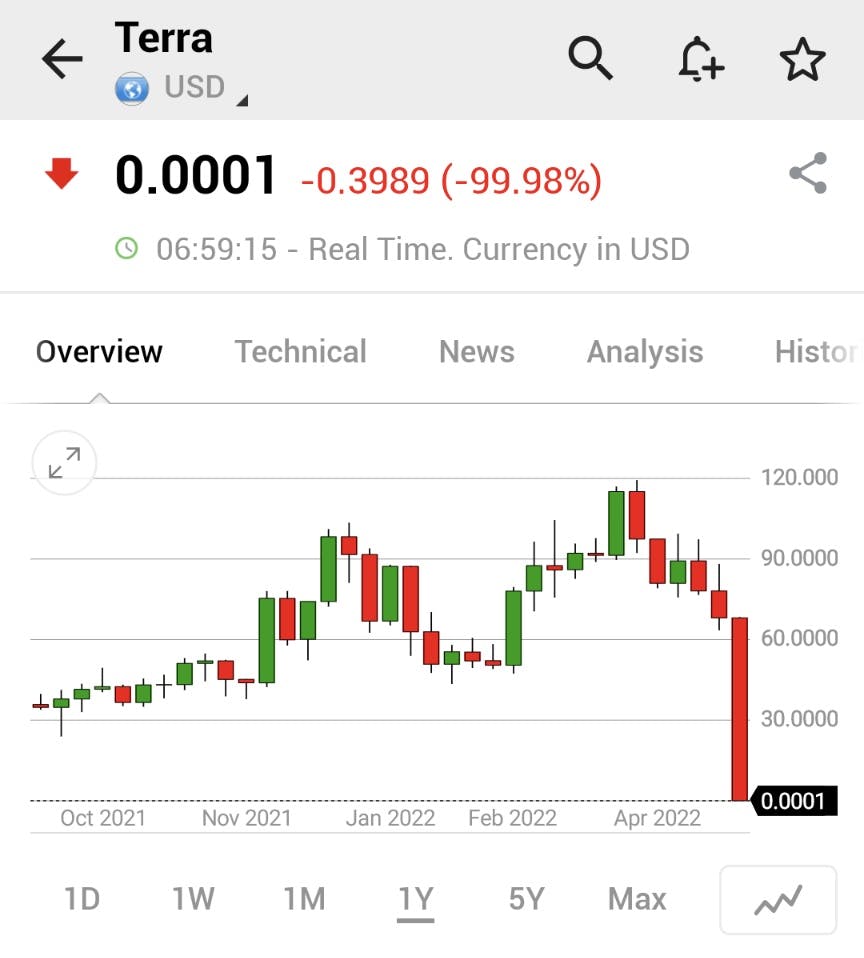

In the past few days, Terra(LUNA) has officially dropped below $0 overnight, losing 100 percent of its value.

Terra, or $UST, is meant to reflect the real value of the US dollar, and traders are supposed to be able to exchange $UST for $1 worth of Terra(LUNA).

$UST is an algorithmic "stablecoin" that uses code to keep its price around $1 by minting and burning coins. Terra UST was designed to maintain its dollar peg through an algorithm-based system that allows it to be swapped for Luna and vice versa to maintain its value.

To keep the dollar peg, a $UST token is created by destroying some of the related cryptocurrency LUNA. When UST fell off the peg in recent days, its backers increased the supply of LUNA coins in an unsuccessful attempt to restore the "stablecoin" to $1.

Luna's price fell as a result of the massive increase in supply. Its peg has been lost and now investors are rushing to dump the LUNA token. Exchange spreads are likely to widen as LUNA experiences low prices and high volatility, leading to exchange delisting LUNA.

This selling has led LUNA into a "death spiral" and eventually, LUNA has crashed to USD0.0001.

Will Terra(LUNA) recover?

LUNA's market cap now stands at under USD1 billion, in stark contrast to its all-time high of around USD25 billion, and because of the enormous units of LUNA minted to re-peg UST in the last few days, its total supply soared from 386 million to over 6.5 trillion. With that sort of market cap and supply, it's going to be very hard for the token to recover even with a bailout scenario.

Conclusion

I will conclude this off by reminding you investors out there to stay vigilant and not jump into any impulsive buying and always remember the golden rule: Invest only with money you can afford to lose.